Calculating capital gain on depreciable property

Selling Price of Rental Property - Adjusted Cost Basis. If we are in a 20 long-term capital gains tax bracket our total taxes on this portion of the gain are.

Determining Holding Period Upon Sale Of Rental Real Estate Dallas Business Income Tax Services

So for example if you purchased an 200000 property and sold it for 500000 then there is a 300000 difference there that may be liable for capital gains tax.

. Proceeds of Disposition - Adjusted Cost Base Total Capital Gain. You take 100 per year in depreciation and four years later you sell it for 600. Selling Depreciated Assets Any profit above the assets depreciated value that results from the sale of the asset is referred to as a capital gain and is taxable.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Can subtract a portion of its depreciable capital property from its taxable. Ad Read this guide to learn ways to avoid running out of money in retirement.

At this point our capital gains tax liability would be. Your in-laws will have to fill out a gift-tax return Form 709 United States Gift and Generation-Skipping Transfer Tax Return if the fair market value of the 50 interest in. Calculate the WDV of the block or the capital gain arising from such sale.

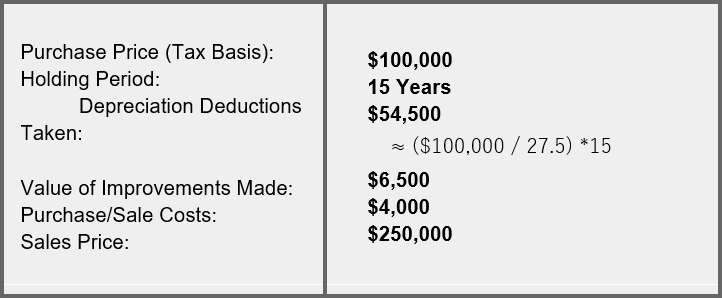

Ad Search For Info About Capital gains tax on property calculator. If the item is disposed of on a capital gain basis then the profit attributable to the asset would be equal to its depreciated price. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Calculation of capital gain from sale of commercial properties. Browse Get Results Instantly. Generally the UCC of a class is the total capital cost of all the properties of the class minus the CCA you claimed in previous years.

X is having a block of. Same Property Rule. If depreciation rules didnt apply you would have a 400 capital loss.

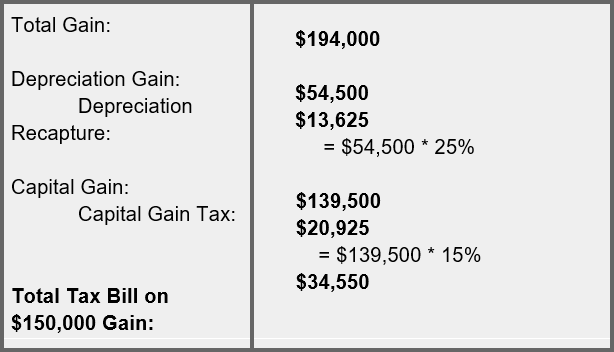

Capital Gains Tax Calculation. Capital Gains x Tax Rate Depreciation x 25 Tax Rate. Tax will be applied to the 400 gain you have if.

A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of. 60000 x 20 tax rate 12000. I say maybe because you.

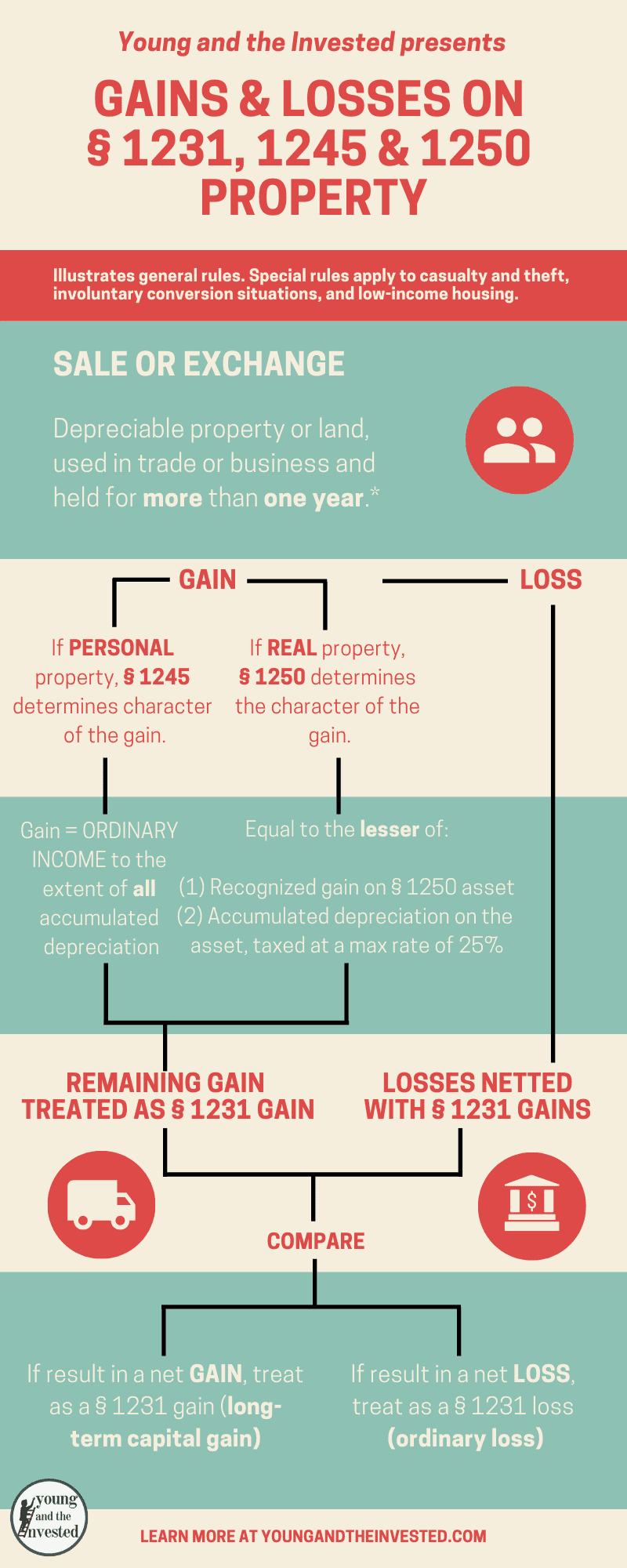

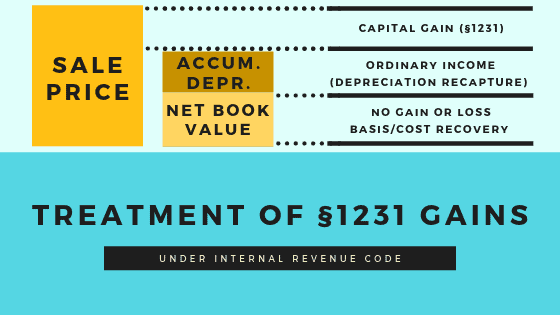

If you have a 500000 portfolio get this must-read guide by Fisher Investments. Other types of depreciable assets while generally qualifying for capital gain treatment can nevertheless result in some or all of that gain being taxed as ordinary income. If you sell depreciable property in a year you also have to.

The tax rate can vary from 0 to. The unrecaptured section 1250 gain can be calculated as 10000 x 11 110000 and the capital gain on the property is 265000 - 10000 x 11 155000.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Solved Joan Sold Depreciable Property Used In Her Business To Irene For 325 000 Cash Plus A Ten Year Bond Par Value 200 000 And Currently Tradin Course Hero

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Contributed Property In The Hands Of A Partnership

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Learn About Depreciation Recapture Spartan Invest

Capital Gains And Losses Sections 1231 1245 And 1250

Converting A Residence To Rental Property

Depreciation Recapture Cost Segregation

Learn About Depreciation Recapture Spartan Invest

Capital Gains And Losses Sections 1231 1245 And 1250

Chapter 8 Capital Gains Business Related 1 Capital Gains Business Avoidance Gaar Capital Receipt Versus Income Receipt Primary Intention Secondary Ppt Download

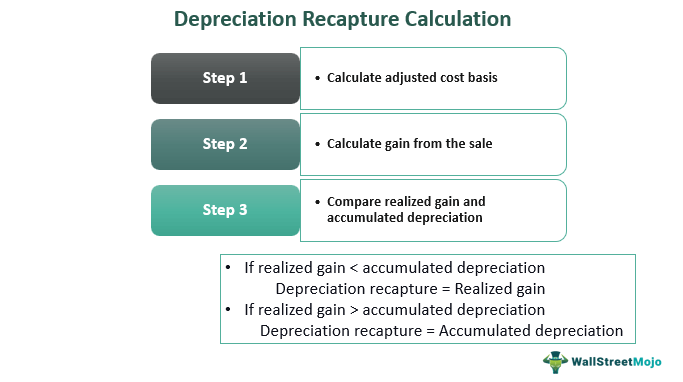

Depreciation Recapture Meaning Calculation Tax Rate Example

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Capital Gains On Depreciable Assets Income From Capital Gains Ipcc Youtube

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker